Cable - COMCAST vs. TIME WARNER CABLE

|

| Great run, but recently has been closing below the 50ma... warning? Looking for a close above the 50ma before considering an entry. |

|

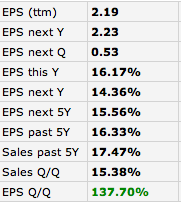

| EPS Growth looks very strong |

|

| Great uptrend. Volume starting to taper a bit, could be taking a rest. Overall looking very strong with very little overhead resistance. |

|

| Strong EPS growth and strong future growth. |

Satellite - DISH vs DTV

|

| Nice breakout after congestion and a restest of that breakout. Look for it to hold above the breakout line. |

|

| EPS growth expected to double next year. |

|

| Consolidating along the 200ma. Stock is printing lower highs so need to look for it to hold above 200ma to consider entry. |

|

| Great Q to Q EPS growth. Sales eh. |

Conclusion:

From a chart perspective $CMCSA and $DISH have the best charts. They have the least overhead resistance.

They both have strong EPS growth and future EPS growth. Which one has the strongest growth potential?

My call for satellite is DISH, with the AMC dispute behind them, they have 53% growth for the year and 50% forecasted for next year. I'm looking for it to hold above consolidation. DISH looks poised to move higher after this consolidation. As always market conditions will prevail and may offer this at a discount.

My call for cable COMCAST. Steady growth, future growth and a steady climbing chart. Time Warner has the LA sports market but Comcast has NBC universal for even bigger growth in my opinion.

Final consideration, overall cable has out performed satellite over the year:

Both cable and satellite stocks are strong why not have a piece of both? Just know how to pick the strongest.

No comments:

Post a Comment