|

| Nice base building on this IPO, looks prime to breakout above 24. |

|

| Long consolidation, tight squeeze on the B-bands. This could be explosive to the upside. Watch this one. |

|

| ZNGA has been beaten to a pulp and is forming a nice base. |

|

| Nice base building on this IPO, looks prime to breakout above 24. |

|

| Long consolidation, tight squeeze on the B-bands. This could be explosive to the upside. Watch this one. |

|

| ZNGA has been beaten to a pulp and is forming a nice base. |

|

| Great run, but recently has been closing below the 50ma... warning? Looking for a close above the 50ma before considering an entry. |

|

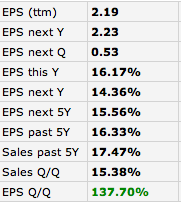

| EPS Growth looks very strong |

|

| Great uptrend. Volume starting to taper a bit, could be taking a rest. Overall looking very strong with very little overhead resistance. |

|

| Strong EPS growth and strong future growth. |

|

| Nice breakout after congestion and a restest of that breakout. Look for it to hold above the breakout line. |

|

| EPS growth expected to double next year. |

|

| Consolidating along the 200ma. Stock is printing lower highs so need to look for it to hold above 200ma to consider entry. |

|

| Great Q to Q EPS growth. Sales eh. |

|

| LONG: Starbucks looking poised for higher prices after a breakout. |

|

| LONG: Eyeing the $10 level poised for a breakout. |

|

| SHORT: Breakdown after consolidation below the 200ma. Looks to head lower. |

|

| LONG: Consolidating and looking poised to breakout and move higher. |

|

| LONG: Looking poised to move higher if it can jump over the 50ma |

|

| LONG: Nice breakout, look to buy on a retest of the 50ma |

|

| LONG: Look to get long on a pullback. Over bought at the moment |

|

| LONG: Looking poised for a breakout and a move higher, watch $USO alignment. |

|

| LONG: Look to buy on a breakout above resistance. |

|

| LONG: Look to buy on a further pullback, overall looking powerful as ever. |

|

| LONG: Breakout after small consolidation. Look to see higher price movement into the holidays. |

|

| LONG: Look to see some buying at this level if it holds support. |

|

| LONG: Looks to be stabilizing and potentially moving higher. Weekly consolidation is looking promising, |

|

| LONG: Middle of this range, Seeing a bit of upside here.. see $BAC |

|

| SHORT: Weekly looking dim, I'm looking to short this on further downside. |

|

| Home builders looking very strong trading at the top of the channel. Almost unaffected by big friday selloff. |

|

| Financials holding up well. Watching support for an entry. |

|

| Right on support with a big volume down day. Next stop the 200ma if we see more downside. |

|

| Broke through support, looking very weak after consecutive lower highs and big selling vol. Not the place to be. |

|

| Resting on support. Trading in tandem with the fib retracement scale. The selling vol and lower highs suggest this downward move could be just getting started. |

|

| Closing right on lower support. Lower highs and big selling volume could mean more downside for the small caps. |

|

| Flirting with resistance, B-bands getting tighter, looks poised for a breakout. Watch the 9.50 level |

|

| Bounce off support, trending nicely |

|

| Coiled up against resistance, could be gearing to move higher |

|

| Look for this to hold above the 19 level, looks like it could keep moving up |

|

| Consolidation on support, looks poised to move higher |

|

| Trending along this support channel, looking for a nice bounce |

|

| Broke out of a volatility squeeze and looking ready to move higher |

|

| Watch this resistance line, further selling next week could be a short opportunity |

|

| Coiling as its building volume, looks very poised to move higher |

|

| Oil breaking above the 200ma and breaking out of a volatility squeeze |

|

| Watch the Bollinger Band expansion after this consolidation breakout. This stock is headed higher. |

|

| SHORT PLAY: Previous high flyer heading lower. Look at the decreased vol on friday following a 5% move up. |

|

| Could be a potential bottom here, several days of buying volume with an 8th day breakout. |

|

| Watch this squeeze here, note the tightened bollinger bands. Hight breakout potential this week. |

|

| Consolidating, looks poised to move higher. |

|

| Watch this consolidation pushing up along resistance, could be a breakout. |