- Travel and Leisure: $EXPE and $HLT are bullish

- Hotels showing spending and recovery. $HLT hitting all time highs

- $EXPE is bullish on strong hotel spending and 2022 outlook

- Airlines are struggling: weakening spending and new variants, Stay away

- Restaurant brands are dismal: policy and Omicron

Travel and leisure stocks made a powerful recovery in 2020. Across the board travel and leisure stocks peaked in March 2021 and have largely moved sideways in 2021. $PEJ - a travel and leisure index ETF has traded just above its 2019 end of year level despite two new variants impacting travel.

Expedia $EXPE similar to $PEJ index with sideways price action since a peak in March while staying above peak 2019 levels. The stock is forming a bullish cup and handle looking prime for a breakout. News of increased travel spending could push it to breakout.

AIRLINES

Airline stocks are struggling to recover. Since the peaking in March, both Delta and Omicron variants have beaten airline stocks down creating lower lows. The index $JETS is currently trading 35% below its 2019 Dec level.

Airline spending trends to lag airline traffic volume as most people tend to purchase their tickets weeks and months ahead of their travel.

Spending shows a 40% drop during the Delta strain with a quick recovery and another 20% drop during Omicron. It is bullish that spending had less of a drop during the holiday season.

HOTELS

Hotel and lodging spending has been strong through 2021 despite occupancy dropping steadily since June.

Hilton $HLT has had a tremendous run hitting all-time highs, pricing in a strong start to 2022. The stock reflects the strong spending chart.

RESTAURANTS

Restuarant recovery has been dismal. OpenTable data shows a drop in reservations 30% below 2019 levels.

New York City was once THE place to be a restaurant owner and has never fully recovered to normal levels according to OpenTable. The data show reservations down nearly 75% from 2019 YO2Y comparisons in part by capacity restrictions, mandates and Omicron. Bottom line: NYC is a tough place to own a sit-down eatery in 2021.

Dallas by comparison recovered much stronger reaching 2019 Baseline levels in early 2021. A combination of shorter lockdown periods and less restrictions helped Texas restaurants get back to normal faster.

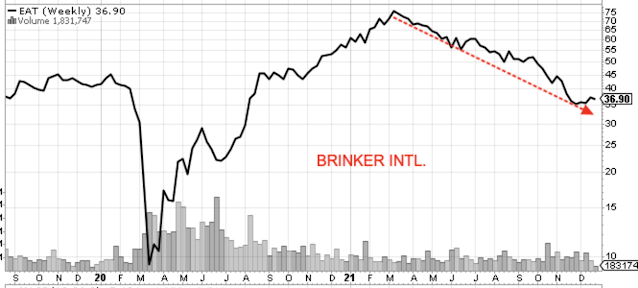

Brinker Intl. peaked in March along with the travel and leisure stocks but then fell 50% going into 2022. With a portfolio of restaurants all over the country, the stock price shows the dismal recovery restaurants have had in the US.

No comments:

Post a Comment